Gearing Up for Growth?CFO-CIO Alignment Drives Success

Strong collaboration delivers benefits for customers, employees, and the business.

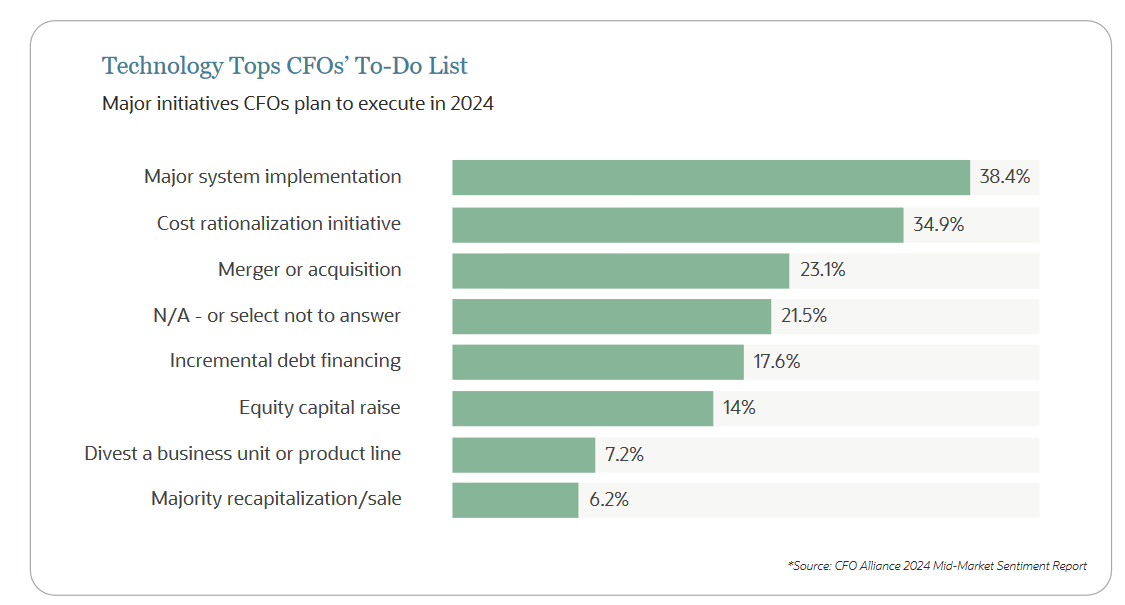

CFOs are making growth plans in 2024. CFOs, on average, expect to see 5% revenue growth this year, according to a recent survey by the Federal Reserve Banks of Richmond and Atlanta. In addition, respondents forecasted GDP growth of 1.7% in 2024—a notable improvement from CFO attitudes back in August 2023, where GDP was only expected to increase 1.3%. And, if budgets are any indication, technology is a big area where CFOs are placing their bets for smart growth and cost-saving opportunities.

In a CFO Alliance–Oracle NetSuite survey of midsize companies, half of respondents said they planned to increase technology spend by more than 5% in 2024, with 18% of that group citing more than a 10% increase. Given the focus on tech investments, the CIO is a critical partner for CFOs crafting efficient growth plans. For CIOs, an ideal finance executive peer is open to thinking through each technology investment and strategizing on adoption plans, with an understanding that it’s more important to buy systems that work well together and fit into the larger technology strategy than it is to have any particular bell or whistle.

Technology buying decisions have moved out of IT’s sole control, with only 30% of CIOs saying that they own or influence more than half of their company’s technology budget in an IDC survey. Instead, department heads—and CFOs in particular—are playing an increasingly significant role in the company’s technology decisions. The value of the CFO-CIO relationship doesn’t go unnoticed. 95% of finance and IT executives agreed that strategic alignment between the two departments is critical to digital transformation success, according to a study from Forrester and CrossCountry Consulting. The not-so-good news? 65% stated that barriers still exist between finance and IT when it comes to a strong CIO-CFO partnership.

As CFOs and CIOs break down those walls to collaborate more closely, there are several areas they should zero in on to ensure their businesses get the most out of the technology they purchase. We’ll walk through five areas for these executives to focus on together to get the maximum impact from their partnership.

Bridge Island of Functionalities

In response to workplace changes over the last few years, both CIOs and CFOs understandably may have added whatever technology offered an immediate solution. However, when each new business problem is solved in a vacuum by a new business system, you risk islands of functionality, overspending, compliance issues—a whole new set of problems that can stifle growth.

The first problem with this approach is it can lead to vendor overload. When technology is purchased from many different vendors, the tech stack becomes more expensive to maintain, both in direct costs and in terms of IT talent dedicated to each system. There may also be duplicative spending—for instance, do you pay for Webex, Zoom, Teams, and Slack? Do different divisions have contracts with different providers for the same work, or even separate instances of the same software? Each system presents a learning curve, so pruning down the number of vendors can not only lower costs but also simplify the job of maintaining and optimizing the use of each application

Second, managing core business processes and data in multiple applications can drag down efficiency. Employees must log in and out of multiple systems and may even have to manually pull together numbers from different sources just to attempt to form a consolidated picture of your operations. And the effort required means you’ll likely do it less often than you should and second-guess the results. For example, cash flow forecasting requires data on your sales pipeline, orders booked, work-in-progress goods, and inventory on hand and on order. In a company with standalone CRM, manufacturing, inventory management, and accounting systems, the finance team must collect data from all four to get a sense of future cash flow.

Third, disparate systems can lead to a less-than- optimal experience for customers and employees. Customers may appreciate the ability to order online, but if your ecommerce site doesn’t accurately show available inventory and projected delivery times, it’ll seem lacking compared with their experience with other sellers’ sites. Your sales team may have similar complaints if the CRM is not integrated with inventory and financial management systems.

The CFO-CIO Impact

By working together from the start, CFOs and CIOs can prevent your business from ending up with an expensive crop of standalone systems. The CIO can start by taking stock of all the systems used by various departments across the business to identify any duplicative technology. Fixing this can immediately eliminate expenses. If it’s time to kick off the search for new technology, these two executives can split up the work. With input from the CIO, the CFO can set a budget, then work with their team to estimate ROI for different options. The CIO can assess the technical capabilities of systems and ensure they meet all functional requirements via collaboration with departmental leaders. If the CIO identifies opportunities to purchase multiple applications from a single vendor, that will typically add to the savings. All of this will help your company avoid shortsighted purchases that present challenges later.

Build Compatible Systems

Whether data can be integrated is often a question that didn’t get thoroughly vetted when you signed the contract for standalone systems, particularly if IT leaders were consulted late in the process—or not at all. This is an issue that can affect your ability to automate processes, get the business insights you’re seeking, and give customers a first-rate experience, so it is a key consideration. Building and maintaining integrations between all of these applications can be a nightmare for the IT team. It often requires assistance from external system experts— who charge steep hourly fees—to set up custom integrations that sync up data from systems that were never intended to communicate. Once completed, these connections may still break frequently, and they may only update data once or twice a day. This is a particular challenge if there are any legacy or homegrown on- premises systems in the mix. Some providers may offer connectors built to map data between two specific systems, and these can make a big difference, but investigate these tools closely to ensure they will work as expected. Getting references about how well integrations work between your specific, essential applications can be as important as references about the system itself. The ideal system limits integrations you need to worry about because the provider offers comprehensive functionality via modules built on a common platform.

“Technology is intrinsic to how business runs. CFOs and CIOs should together make clear that new systems must be easy to own, configure, use, and integrate.”

The CFO-CIO Impact

Whether your systems can work together to deliver on their promise requires the expertise of IT leaders. CIOs bring a valuable perspective to any system selection process because most have firsthand experience with expensive projects that resulted in unreliable or failed connections between systems. That helps them spot the red flags and what it would take to fix them early on. Based on the CIO’s insights, finance heads can make a short list of systems that meet the needs of various stakeholders without presenting major integration headaches. Even if you have to make a few concessions, when CFOs and CIOs are on the same page, they’ll realize that the cost savings and simplification of your tech stack is a tremendous benefit.

Improve Processes Alongside Technology

Adding technology to quickly resolve one issue comes with another glaring problem: You might just be further automating a bad process. The quick fix means you didn’t trigger the business process refreshes you needed. When people are focused on fixing one specific problem, they’re less inclined to launch a true business process re-engineering and optimization effort. But that effort is what’s needed to get full value out of the technology you’ve added. Prior to ecommerce, once inventory hit a store’s loading dock, it was that store’s to sell. In rare cases, associates might check with other locations for a customer, but stock was largely localized. The rising importance of ecommerce means many businesses have had to rethink the wisdom of localized inventory management. Imagine a retailer that stocks 5,000 SKUs across five stores and has a growing ecommerce business. Figuring out what and how much to order based on the current stock levels of your stores, what you’ve already ordered and allocated, and minimum order sizes is almost impossible to manage manually. Mistakes have a clear bottom-line impact: missed sales or steep carrying costs due to too much inventory.

“A new inventory management system to support an increasing focus on ecommerce is a great example of a process that many companies haven’t re-examined”

Other process improvements that could come with inventory management software include widespread use of handheld devices for scanning products so available inventory immediately updates in real time and you can do inventory counts without ceasing sales. You may even add a warehouse management system (WMS) to support the picking method most efficient for your operation. And, if the WMS is connected to your financial and ecommerce systems, customer and financial records will update automatically as items are shipped, with updates automatically sent out to customers.

When Rethinking Processes, Start with OKRs

Whether you decide to review processes internally or enlist the help of a consultant, looking at every business process is likely not practical. One way to focus is for management to establish objectives and key results, or OKRs. OKRs are are high-level companywide goals that set the stage for more targeted processes. One possible OKR might be to generate a 20% increase in revenue while achieving a 30% bump in net earnings. Another might be to increase revenue from existing customers by 30%. Yet another might address staffing: Achieve the above goals without new hiring. Starting there, you could form a team to identify where the new revenue will come from and establish another group to look at how it can be achieved without a linear ramp-up on costs or staff.

The CFO-CIO Impact

Such process changes are only possible with assistance and buy-in from people across the business. The CFO and CIO can take the lead on mapping out major problem points across the organization and then determine what it would take to fix them. In most cases, it will be a combination of process and technology changes, but it could be either. Again, the IT head can help their finance peer understand any technical challenges presented by their vision for the future. Perhaps a change in order fulfillment processes would strain the system that calculates shipping rates and prints labels, for example. And the CFO might point out that using separate systems for accounting and AP automation could lead to delayed payment approvals. The CFO and CIO both have a vital role to play in recasting processes to maximize returns on technology investments and minimize unforeseen issues.

Listen To Your Customers

For consumer goods and services companies: Analyzing survey results alongside buying trends can offer important clues about what really delights customers. There’s also a lot of value in simply talking to clients. However you collect insights, compiling data and talking to customers about their individual experiences is a critical step in understanding how you’ll set your business up for growth and how you can rise above competitors.

For B2B companies: A quarterly business review process is the perfect time to understand what customers like and what they would change about your products and services. Providing the level of data transparency you like from suppliers to your customers is incredibly helpful to them. It lets your customers depend on you more because they can see your product availability, delivery schedules, and more.

“The business review is one of the most

underrated tools in a services company’s arsenal. They allow you to discover new ways to help clients achieve their goals, uncover risks and opportunities, and ensure customer leadership sees you as critical to growth. If you already do regular reviews with clients, you know how valuable they are. If not, here’s how to start.”

The CFO-CIO Impact

Bringing their unique perspectives, the CFO and CIO can work in concert to brainstorm better ways to collect and then analyze this data. Perhaps you aren’t asking the right questions, the results are difficult to parse, or you lack the right tools to draw broad insights from the findings. Together, these two executives can brainstorm potential improvements and the system adjustments required to support them. In B2B settings, they might also talk to peers at top customers to understand how they could be a better partner. The CIO might dig into opportunities for their respective systems to work together better. Customers will appreciate executives showing interest and likely come to the table with plenty of actionable ideas.

Create a Better Employee Experience

Part of today’s new business reality is that, with still more than one opening for every jobseeker, worker satisfaction can have a major financial impact on your organization. It can determine whether you have the talent you need to meet customer demand and foster positive customer experiences. Workers want to have confidence in their employer’s success, and they want to contribute to that in a meaningful way. Automation is part of the solution to increasing employee satisfaction and engagement. In truly digital businesses, rote, repetitive tasks are done by technology. Taking human error out of the equation and letting information workers instead focus on analyzing information is going to be a clear win. Artificial intelligence will increasingly play a role in that automation, with AI embedded in existing applications a common starting point because it can make an immediate impact. But making this tech-forward environment a reality will be an uphill battle without executive backing and alignment. Businesses need to understand what’s held them back in the recent past and how they can empower employees to resolve them. Maybe projects consistently take longer or cost more to execute than expected. How can you improve the accuracy of estimates? Conversely, were delays and budget overruns caused by the same issues from one project to the next? Perhaps cost of goods sold crept up, and you didn’t have the data in real time to know it was happening and what was causing it. On the workforce front, do employees feel limited in their ability to experiment with new ideas or to make decisions on their own in the name of speed? Are they spending too many of their working hours on unfulfilling tasks that the right software could automate? Meaningful improvement here starts with the C-suite.

The CFO-CIO Impact

As key members of the leadership team, the CIO and CFO can gather input from their respective organizations and build a plan for creating a more rewarding workplace. That includes figuring out the role of technology in making this happen. For example, the CIO and CFO are top candidates to take the lead on assessing the potential of AI technology, from technical readiness to business value. The finance and IT chiefs can also partner to determine whether they are 1) measuring the right metrics for success and 2) can accurately and reliably track those numbers. This will give employees confidence that they’re doing their parts to meet OKRs or other goals as set by leadership, boosting engagement.

The Case for ERP

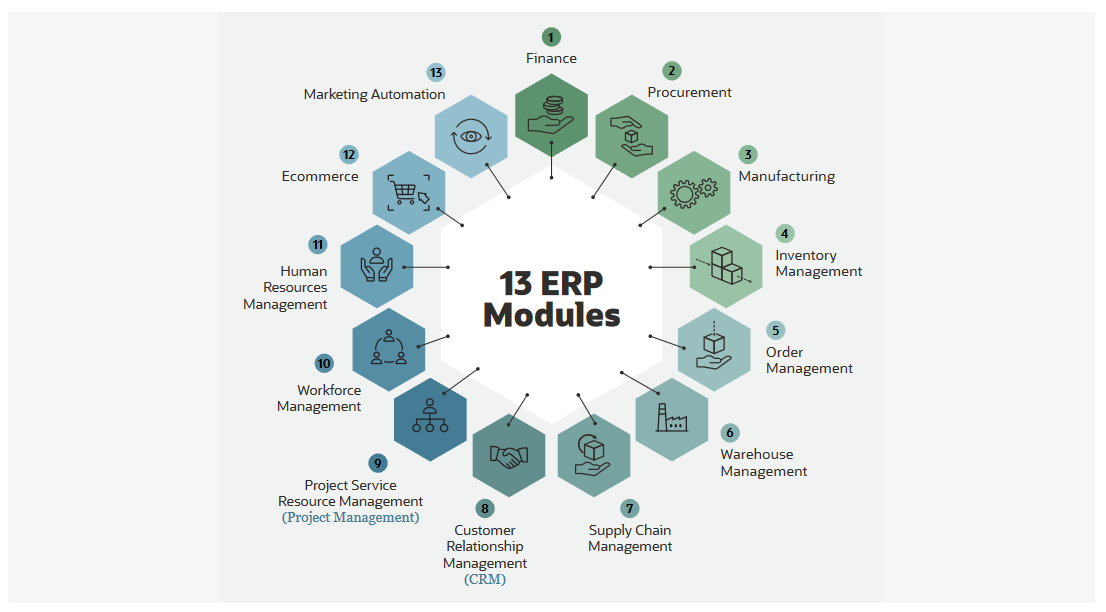

It’s hard to imagine a successful, highly efficient, business beyond a certain size that runs on simple accounting software. As the business grows, the month-end close becomes more difficult, data isn’t centralized, business insights take too long to generate, and manual processes are increasingly error-prone. Not automating AR and AP is a sure way to lose the interest of workers as they drone on writing and cashing hundreds of checks a month and manually reconciling accounts.

“When a business grows to include subsidiaries or operate in multiple countries or tax zones, basic accounting software becomes a clear liability.”

The ERP journey usually starts with finance and then naturally expands to other essential functions as the team gets more comfortable with the system and additional needs present themselves. When evaluating ERP systems, prioritize how easily each can add features as you grow and connect to other foundational technology. This is why it makes sense to choose an ERP vendor such as NetSuite that has modules to support various aspects of your business while keeping financials at the heart of the platform. That includes applications for inventory and order management, professional services automation, financial planning and budgeting, HR, CRM, and more. Adding this functionality does not require integrations because the modules share a common codebase and are designed to work together. NetSuite’s approach makes it much easier to give executives the consolidated view of the company they crave since all or most of your business functions are in one place. And a single suite brings another key benefit for IT: It lets that team become experts in how to manage, operate, and train others in one system.

The CFO and CIO can then focus on process re- engineering and how the ERP system can support efforts to better serve customers and employees. They’ll do so confident that their shared expertise and alignment is helping drive the organization forward.